Paul Gaggl’s Research

My main research interests are

- Macroeconomics

- Labor Economics

Media Coverage

- Listen to my NPR Appearance in a discussion on the role of automation for the future of jobs, which draws on many of the research projects below.

- Read my VOX EU columns summarizing some of the research projects below.

- Read my co-author’s New York Times piece drawing on insights from one of our recent projects.

Working Papers

- Structural Change in Production Networks and Economic Growth [pdf]

joint with Aspen Gorry and Christian vom Lehn. Revise and Resubmit at Review of Economic Studies

(this version: November 2023)

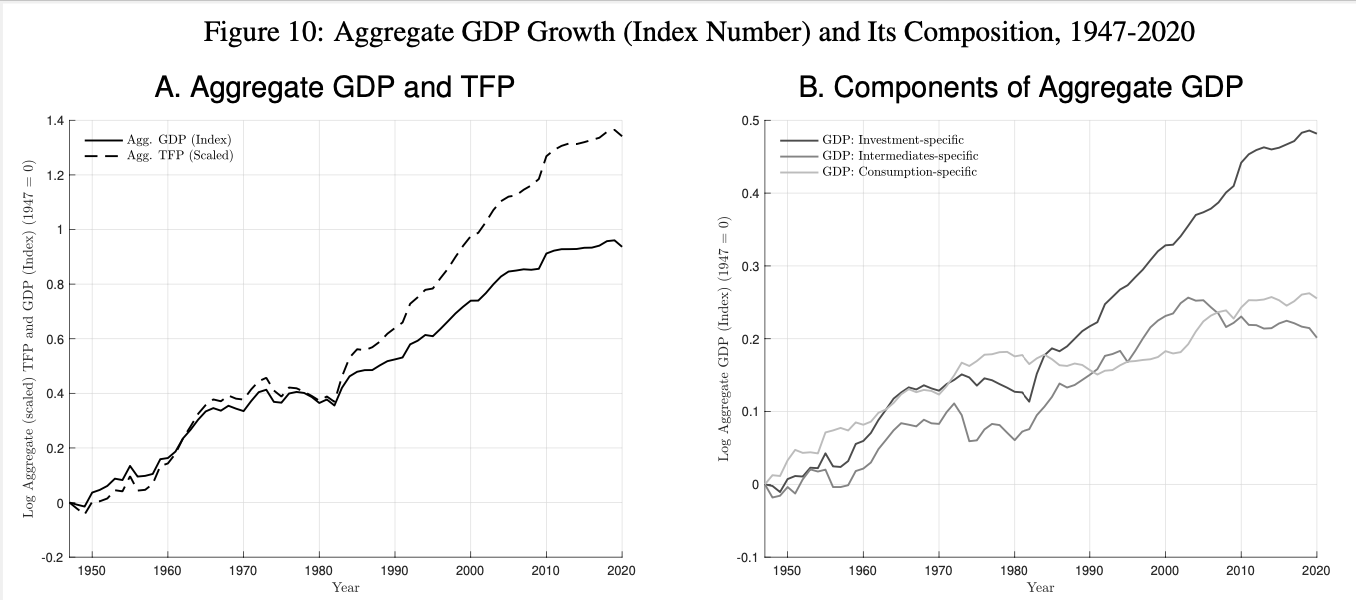

CESifo Working Paper No. 10460We study structural change in production networks for intermediate inputs (input-output network) and new capital (investment network). For each network, we document that the share of output produced by goods sectors has declined since the 1950s, offset by a rising fraction of production by services sectors. We develop a multi-sector growth model to study these trends and show that our framework admits an aggregate balanced growth path with such structural change. Calibrating the model using disaggregated expenditure-side price data for the United States, inputs to intermediates production are complements, and in contrast to existing literature, inputs to investment production are substitutes. Hence, structural change in production networks implies that resources endogenously reallocate to the slowest growing intermediates producers and the fastest growing investment producers. As a result, we show that investment-specific technical change ac- counts for an increasing share of U.S. aggregate growth, rising from 30-40% of growth prior to the 1980s to more than 70% since the year 2000. In addition, more than 20% of aggregate growth after 2000 stems from endogenous reallocation induced by structural change. At the same time, productivity growth within the input-output network has stagnated, accounting for the bulk of the recent slowdown in aggregate growth.

- Capital Composition and the Declining Labor Share [pdf]

joint with Maya Eden.

(this version: November 2019)

CESifo Working Paper No. 7996 [pdf]To what extent can technological advances in the production of capital account for the recent, worldwide decline in the labor income share? We pose two challenges to the automation narrative: first, estimates of the elasticity of substitution (EOS) between capital and labor tend to fall below or around one, suggesting that a decline in the price of capital should not lead to a decline in the labor income share. Second, we illustrate that, despite technological improvements, the price of capital relative to output has remained roughly constant, worldwide. This poses a challenge to the view that cheaper capital has caused the displacement of workers. We show that a more nuanced approach, which takes seriously the composition of capital, ascribes a prominent role to the automation hypothesis. Though information and communications (ICT) capital is a small fraction of the capital stock, it is highly substitutable with labor, and its user cost declined sharply over the last few decades. A framework that distinguishes between ICT and non-ICT capital is empirically plausible and suggests that automation accounts for more than one quarter of the global decline in the labor share, even if the aggregate EOS is substantially less than unity.

Recent Publications

- Does Electricity Drive Structural Transformation? Evidence from the United States [pdf]

joint with Rowena Gray, Ioana Marinescu, and Miguel Morin. In Labour Economics

(accepted version: October 2020)

Published Version (DOI: https://doi.org/10.1016/j.labeco.2020.101944)

NBER Working Paper No. 26477 [pdf]Electricity was the catalyst for the second industrial revolution in the early twentieth century. Developing countries are currently making huge investments in this general-purpose technology, with a view to achieving structural change. What can history teach us about its impact on the structure of employment? We use U.S. Census data and an identification strategy based on hydroelectric potential to identify the effects of the geographic expansion of higher-voltage electricity lines. We find that, over the period 1910–1940, electrification increased the share of operatives in the average county by 3.5 percentage points and decreased the share of farmers by 2.9 percentage points. These effects are primarily driven by rural electrification, and they can account for more than half of the aggregate increase in operatives, and more than one quarter of the total decrease in farmers. These results suggest that electrification was a key contributor to U.S. structural transformation.

- The Cyclical Component of Labor Market Polarization and Jobless Recoveries in the US [pdf]

joint with Sylvia Kaufmann. In the Journal of Monetary Economics.

(accepted version: 10-29-2019)

Published Version (DOI: https://doi.org/10.1016/j.jmoneco.2019.11.005)

Online Appendix [pdf]

Data [zip]

Older version with international evidence (3-7-2015) [pdf]Based on quarterly occupation-level data from the US Current Population Survey for 1976-2013, we exploit common cyclical employment dynamics to identify two clusters of occupations that roughly correspond to the widely discussed notion of “routine” and “non-routine” jobs. After decomposing the cyclical dynamics into a cluster-specific (“structural”) and an occupation-specific (“idiosyncratic”) component, we detect significant structural breaks in the systematic dynamics of both clusters around 1990. We show that, absent these breaks, employment in the three “jobless recoveries” since 1990 would have recovered significantly more strongly than observed in the data, even after controlling for observed idiosyncratic shocks.

- Do Poor Countries Really Need More IT? [pdf]

joint with Maya Eden. In World Bank Economic Review, July 2019.

(accepted version: 03-27-2018)

Published Version (DOI: https://doi.org/10.1093/wber/lhy022)

Online Appendix [pdf]Popular/Press coverage: VOX EU, World Economic ForumProductivity differences across countries are often attributed to differences in technological capabilities. This paper asks whether there are systematic cross-country differences in the adoption of information technologies (IT). We document a positive correlation between IT use and income, which weakens over time. However, given that IT use is an endogenous outcome of both technological capabilities and the abundance of complementary factors of production, it tends to over-state the degree of cross-country differences in technology. We propose two novel calibration approaches to address this problem. After accounting for endogenous differences in industrial composition, we find that there is no systematic relationship between income and IT capabilities.

- On the Welfare Implications of Automation [pdf]

joint with Maya Eden. In Review of Economic Dynamics, July 2018.

(accepted version: 11-13-2017)

Published Version (DOI: https://doi.org/10.1016/j.red.2017.12.003)

Data and Replication Files

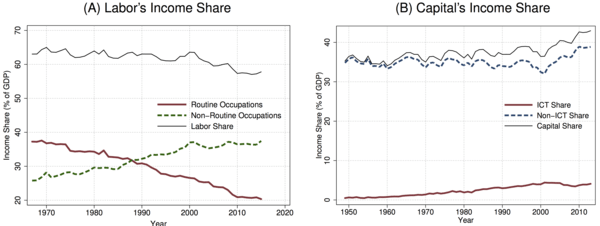

Popular/Press coverage: New York Times, Nada es gratisWe document that the decline in the labor income share since the 1950s has been countered by a rise in the income share of capital goods that embody information and communication technology (ICT). In parallel, there has been substantial reallocation of labor income from occupations relatively substitutable with ICT (routine) to ones relatively complementary (non-routine). These trends are consistent with the view that ICT allows for the mechanization of tasks that traditionally required labor, a process known as automation. Our calibration suggests that automation can account for half of the decline in the labor share, but that it is unlikely to be the sole driver of the decline in the routine labor income share. A representative agent framework suggests welfare gains of 4%.

- A Short-Run View of What Computers Do: Evidence from a UK Tax Incentive [pdf]

joint with Greg Wright. In American Economic Journal: Applied Economics, July 2017.

(accepted version: 8-16-2016)

Published Version (DOI: https://doi.org/10.1257/app.20150411)

Online Appendix [pdf]

Popular/Press coverage: VOX EU, World Economic ForumWe study the short-run, causal effect of Information and Communication Technology (ICT) adoption on the employment and wage distribution. We exploit a natural experiment generated by a tax allowance on ICT investments and find that the primary effect of ICT is to complement non-routine, cognitive-intensive work. We also find that the ICT investments led to organizational changes that were associated with increased inequality within the firm and we discuss our findings in the context of theories of ICT adoption and wage inequality. We find that tasks-based models of technological change best fit the patterns that we observe.

- Do Banks Take Unusual Risks When Interest Rates are Expected to Stay Low for a Long Time? [pdf]

joint with Maria T. Valderrama. Macroeconomic Dynamics, September 2019.

(accepted version: 02-21-2017)

Published Version (DOI: https://doi.org/10.1017/S1365100517000748)

Online Appendix [pdf]The financial woes that initiated the current economic slump have, at least in part, been traced to excessive bank risk-taking. What induced this behavior? One explanation are persistently low short-term interest rates during the mid-2000s. We exploit an extensive panel of matched Austrian banks and firms during 2000–2008 to investigate the effects of the ECB’s policy of persistently low interest rates during 2003q3-2005q3. Our analysis suggests that this period likely caused Austrian banks to hold risker loan portfolios in response to cheaper short-term funds, than they would have in the absence of this policy.

Dormant Papers

- The Impacts of Ending Long-Term Unemployment Insurance: Evidence from North Carolina [pdf]

joint with Craig Depken. Revision requested by Economic Inquiry.

(this version: 02-14-2016)We investigate the causal effect of ending long-term emergency unemployment insurance (EUI) payments on labor market outcomes. Federal EUI payments in North Carolina (NC) expired on July 1, 2013, while EUI provision continued in all other states through December 31, 2013. We exploit cross-state variation generated by this unexpected NC law change to identify the causal effect of ending EUI payments. Our results indicate that the policy change induced a 1pp decrease in NC’s unemployment rate, primarily due to unemployed individuals finding employment. However, these employment gains were concentrated in part-time jobs and among single females with children.

- Did Banks Lend in Herds During 2000–2008? [pdf]

joint with Maria T. Valderrama. Revision requested by Empirical Economics.

(this version: 09-09-2013)Systemic risk was one of the greatest concerns during the financial crisis of 2007/2008. But why did financial institutions choose asset portfolios that were highly correlated with their peers’? We seek to identify the degree to which financial institutions intentionally followed the actions of their competitors. Based on a matched bank-firm panel we construct three time varying measures of bank “herding” within the Austrian business loan market for the period 2000-2008. These measures indicate sizable degrees to which banks were copying their peers’ actions throughout the 2000s, particularly during the episode of low policy interest rates during 2003-2005.

Other Publications

2016

- The Impact of Education Earmarking on State Level Lottery Sales [doi], joint with Carol O. Stivender, Louis H. Amato, and Tonya E. Farrow-Chestnut. In The B.E. Journal of Economic Analysis and Policy, volume 16, issue 3, pages 1473-1500, May 2016.

2011

- Does a Low Interest Rate Environment Affect Risk Taking in Austria? [pdf], joint with Maria T. Valderrama. In Monetary Policy & the Economy, Austrian Central Bank, issue 4, pages 32-48, January 2011.

2009

- Will the Great Recession Lead to a Lasting Impact on Potential Output in Austria? [pdf], joint with Jürgen Janger. In Monetary Policy & the Economy, Austrian Central Bank, issue 3, pages 26-52, November 2009.

- The Role of Exchange Rate Movements for Prices in the Euro Area [pdf] In Monetary Policy & the Economy, Austrian Central Bank, issue 2, pages 83-103, August 2009.

- The Short and Long-run Interdependencies Between the Eurozone and the U.S.A. [pdf], joint with Serguei Kaniovski, Klaus Prettner and Thomas Url. In Empirica, Springer, vol. 36(2), pages 209-227, May 2009.